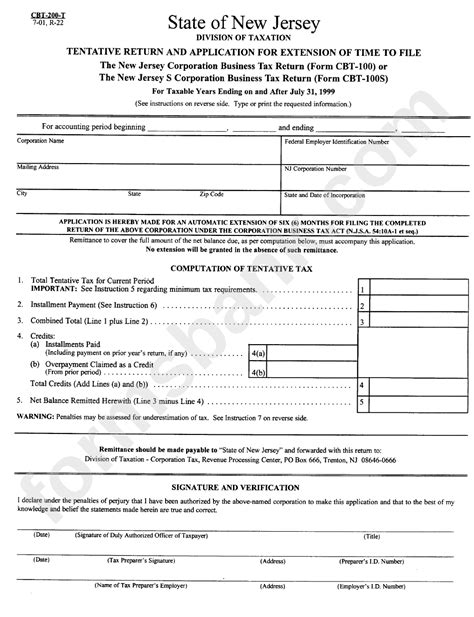

form cbt 200 t|cbt s estimated quarterly payment : Pilipinas The form has been pre-filled with your company's identifying information -- name, address and FEIN, as well the reporting period and return due date. If any of the identifying data .

web4K. Alle utlendinger har lukka gardiner is not available for streaming. Let us notify you when you can watch it. Notify me. Something wrong? Let us know! Synopsis. How wonderful and awful isn't it to be in love when you .

0 · nj part 200 t instructions

1 · nj form cbt 200 tc

2 · nj form cbt 200 t extension instructions

3 · nj cbt 200 t instructions

4 · new jersey cbt 200 t

5 · cbt s estimated quarterly payment

6 · cbt 200 t instructions 2022

7 · cbt 200 t instructions

8 · More

WEB6 dias atrás · In addition, with the application you can have access to a world of possibilities: - Access your digital account. - Check your balance, statement and available limits. - Request your KardBank Elo card. - .

form cbt 200 t*******Note: Form CBT-100-U is online for reference purposes only. Returns must be filed electronically. CBT-100U - Combined Filer: CBT-100U (Instructions) . CBT-200-T : .

CBT-200-T CORPORATION BUSINESS TAX TENTATIVE RETURN AND APPLICATION FOR EXTENSION OF TIME TO FILE. Payments should be made electronically. Refer to .

Combined Filers. The Managerial Member must file the Tentative Return and Application for Extension of Time to File (Form CBT-200-T) and pay any tax liability on .

Insufficiency Penalty:- If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100, or in the case of a .EXTENSION OF TIME TO FILE RETURN/INSTRUCTIONS FOR FORM CBT-200-T: AUTOMATIC EXTENSION: Where a tentative return, Form CBT-200-T, and tax .The form has been pre-filled with your company's identifying information -- name, address and FEIN, as well the reporting period and return due date. If any of the identifying data .form cbt 200 tYou can use the PIN on the REG-C form supplied with your NJ-927 Quarterly Employer Report or on the PIN coupon inside your ST-50/51 Sales and Use Tax coupon booklet, if .To request a New Jersey business extension, use Form CBT-200-T (Corporation Business Tax Tentative Return and Application for Extension of Time to File). If you owe New .

The form has been pre-filled with your company's identifying information -- name, address and FEIN, as well the reporting period and return due date. If any of the identifying data is incorrect you should contact the Client Registration Unit of the Division of Revenue. All fields in red must have a minimum value of $0. New Jersey Corporate Business tax extension Form. CBT-200-T is due within 4 months and 15 days following the end of the corporation reporting period. To file an extension for Form. CBT-100S, apply for an extension using Form CBT-200-T on or before the same date the business tax return is due. Form CBT-200-T grants an automatic 6 .form cbt 200 t cbt s estimated quarterly paymentForm CBT-200-T is a New Jersey Corporate Income Tax form. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns, which can be obtained by filing the proper extension request form. Obtaining an extension will prevent you from being subject to often very large failure-to-file .

If you file Form PART-200-T, you must also file Form PART-100 “Partnership Return Voucher” when you file Form NJ-1065. Line 1. Filing Fee. Enter the amount from Line 4 of the Filing Fee Schedule located on the back of Form PART-200-T. Do not enter more than $250,000. If you have less than three owners or if you do not have income or loss .Schedule A-7 and Schedule L have also been discontinued. For privilege periods ending on and after July 31, 2023, banking corporations and financial business corporations that are separate filers must use Form CBT-100. In addition, any ancillary forms (e.g., Form BFC-200T) have also been discontinued.These forms are for reference only. DO NOT mail to the Division of Taxation. Form CBT-100 and all related forms and schedules must be filed electronically. See our website for more information. 2023 – CBT-100 – Page 1 Federal Employer I.D. Number N.J. Corporation Number State and date of incorporationForm CBT-100-V will be produced when the amount due is greater than zero. Form CBT-200-TC will be produced for this type of return when "NJ" is entered in the State Code of federal Other worksheet, Extensions section. This field should also be used to produce inactive banking and financial corporation returns. If an entry is made here when Form .cbt s estimated quarterly payment Insufficiency Penalty – If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100S, or in the case of a taxpayer whose preceding return covered a full 12-month period, is less than the amount of the tax computed at the rates applicable to the current accounting year but on .EXTENSION OF TIME TO FILE RETURN/INSTRUCTIONS FOR FORM CBT-200-T: AUTOMATIC EXTENSION: Where a tentative return, Form CBT-200-T, and tax payment are timely and properly filed, it is the policy of the Division of Taxation to grant an extension of no more than six (6) months for filing the CBT-100S. .EXTENSION OF TIME TO FILE RETURN/INSTRUCTIONS FOR FORM CBT-200-T: AUTOMATIC EXTENSION: If a tentative return, Form CBT-200-T, and tax payment are timely and properly filed, it is the policy of the Division of Taxation to grant an extension of no more than six (6) months for filing the CBT-100.CBT200-T EXTENSION RETURN. You have been presented with your online ST-450/ST-450A Sales and Use Tax Return form. The form has been pre-filled with your company's identifying information -- name, address and FEIN, as well the reporting period and return due date. If any of the identifying data is incorrect you should contact the Client .

Insufficiency Penalty – If the amount paid with the Tentative Return, Form CBT-200-T, is less than 90% of the tax liability computed on Form CBT-100S, or in the case of a taxpayer whose preceding return covered a full 12-month period, is less than the amount of the tax computed at the rates applicable to the current accounting year but on the .

Resultado da 28 de nov. de 2023 · The first expansion for Dune: Imperium , Rise of Ix expands and deepens the thrilling gameplay that has made Dune: Imperium one of the best board games of recent years. Acquire technology for lasting benefits. Dominate the battlefield with mighty dreadnoughts. Outmaneuver .

form cbt 200 t|cbt s estimated quarterly payment